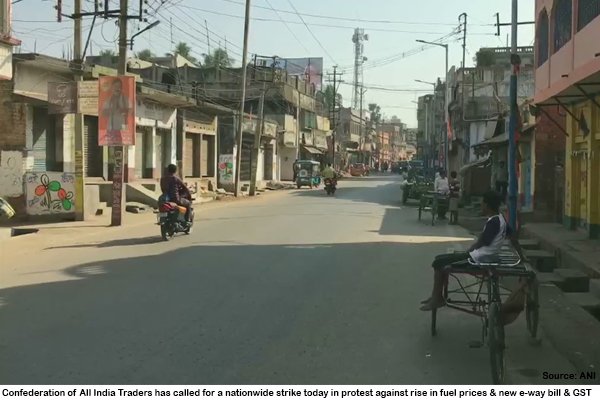

New Delhi: In the wake of the Bharat Bandh called by the Confederation of All India Traders (CAIT) in protest against rising fuel prices, new E-way bill and Goods and Services Tax (GST), all commercial markets across the country today (February 26) will be closed. In response to CAIT’s call for Bharat Bandh, around 40,000 business organizations have decided to lend their support.

The All India Transport Welfare Association (AITWA) – the apex body of organized road transport companies – will support today’s bandh and blockade. All state level transport associations including Bombay Goods Transport Association, SIMTA, KGTA, Baroda Goods Transport Association, Vapi Transport Association, HGTA, CGTA, Car Carrier Association, Transporters Poona and many others have confirmed their support to AITWA in this one.

These services are expected to be affected

Commercial markets across the country will remain closed as more than 40,000 merchant associations are participating in Bharat Bandh.

Road transport services across the country can be affected as transport companies park their vehicles between 6 am and 8 am.

Booking, as well as movement of bill-oriented items, will be affected.

No merchant will log in to the GST portal to register their protest.

Associations of Chartered Accountants and Tax Advocates have supported the strike. Therefore, their services are likely to remain affected.

According to CAIT Secretary General Pravin Khandelwal, women entrepreneurs, small industries, hawkers, others will join tomorrow’s bandh.

Wholesale and retail markets will remain completely closed.

Services that will not be affected

Essential services, medical shops, milk, vegetable shops, etc. will not be affected by the Bharat Bandh.

Bank services are also expected to remain unaffected.

Why is India closed today?

E-way Bill

CAIT as well as AITWA are seeking to abolish the new e-way bill or to abolish some of it rules. E-way bill system has been introduced nationwide for inter-state movement of goods from 1st April 2018.

What is E-way Bill?

This is a rule that mandates impractical compliance with transporters. The consignment or sender has to fill their cargo details on the online portal, in Part A and the transporter has to update the vehicle number in Part B. The transporter has to travel a total distance of 200 km / day from the consignment location.

From the sender’s place to the place of the sender according to the pin code calculated over the shortest distance. This is practically not possible due to many factors such as Sunday / Holiday, accident, part load consolidation, hub and spoke, congestion en-route or unloading place, driver personal issue and many more. Goods are sometimes stored before delivery according to customer convenience.

Any mistake or termination of an e-way bill due to any mistake that is punishable by 200 percent of the tax value, or 100 percent of the invoice value under section 129 of the CGST Act, 2017, even when the government has lost any tax Does not occur. Further, this tax on sale / purchase is to be paid by the government to the seller / buyer and has nothing to do with the transporter.

Rising fuel prices

In addition to the E-way Bill, EITWA has also opposed skyrocketing diesel prices, which should be reduced and future regulation required to discuss and build mechanisms with the transport industry. According to the All India Transporters Welfare Association, diesel prices should be cut.

GST

CAIT Secretary General Pravin Khandelwal said that voluntary compliance is the key to a successful GST regime, as it will encourage more people to join the indirect tax system, increase the tax base and increase revenue. About 950 amendments to the GST rules have been made so far in the last four years, he said, adding that the GST portal malfunction and continuous increase in compliance burden is the main reason for opposition to this tax.