Now, this pillar of China’s integration with the global financial system is increasingly under threat. For more than two decades, Chinese companies have turned to the US stock market for capital and international prestige, raising at least $ 144 billion from some of the world’s largest investors. Now, this pillar of China’s integration with the global financial system is increasingly under threat.

The latest setback came on New Year’s Eve, when the New York Stock Exchange said it would deal with three state-owned telecommunications companies to comply with Donald Trump’s November order to be owned or controlled by the military Prohibited US investments in fixed Chinese companies. It is the first time a US exchange has removed a Chinese company as a direct result of rising geopolitical tensions under the outgoing Trump administration.

While the impact on China Mobile Limited and its two peers is likely to be minimal given the trading of its shares in Hong Kong, the delisting underscores the risks for both Chinese and American companies as tensions between the superpower boil. Shares of China’s largest offshore oil producer fell in Hong Kong and according to US speculation the company may be next in line for delisting.

Businesses without military links are also unsafe after President Trump signed the law with bipartisan support last month, which could shut down US firms until US regulators review their financial audits.

“Forcing Chinese companies to move out of the U.S. or be delisted,” said George Magnus, a research associate at Oxford University’s China Center and author of “Red Flags: What’s China in the China of the Japanese” Does matter.” “A listing nowadays seems to be a less attractive proposition, especially if you are a state-owned enterprise with close links to the People’s Liberation Army or internal security,” Magnus said.

What is of concern to American companies is that their access to China’s vast economy can be prevented by any expansion of tight-to-tat restrictions. Wall Street banks are particularly keen to ease tensions after gaining unprecedented scope to operate in China last year. China’s securities regulator responded to the delimitation by calling them baseless and “not a wise move”, although it did not formulate a plan of retaliation.

The NYSE said it would suspend trading in US depository shares of China Mobile, China Telecom Corp and China Unicom Hong Kong before January 11. In his executive order, Trump said the companies were among those directly supporting the Chinese military, intelligence. And security assessment and assistance in their development and modernization.

China Unicom and China Mobile said they are reviewing ways to protect their “legitimate rights”. China Telecom said it is considering options “to protect the legitimate interests of the company”.

The Securities Regulatory Commission of China said in a statement on 3 January that the affected shares are worth less than 20 billion yuan ($ 3.1 billion) and equal to 2.2% of the total shares of each company. To handle any outcome.

Firms in New York Trading fell to US depository receipts from Monday, as China’s Telecom declined 5.5%. China Mobile’s price fell 5.9% to its 2006 low and China Unicom slipped 3.2%. The three companies reported a fall in Hong Kong on Tuesday.

China Mobile was one of the first large companies in the country to sell part of the “red chip” boom in the US in 1997, facing the Asian Red Crisis. The IPO performed poorly on its debut but still faced flooding. Chinese listings in the US in the coming decades.

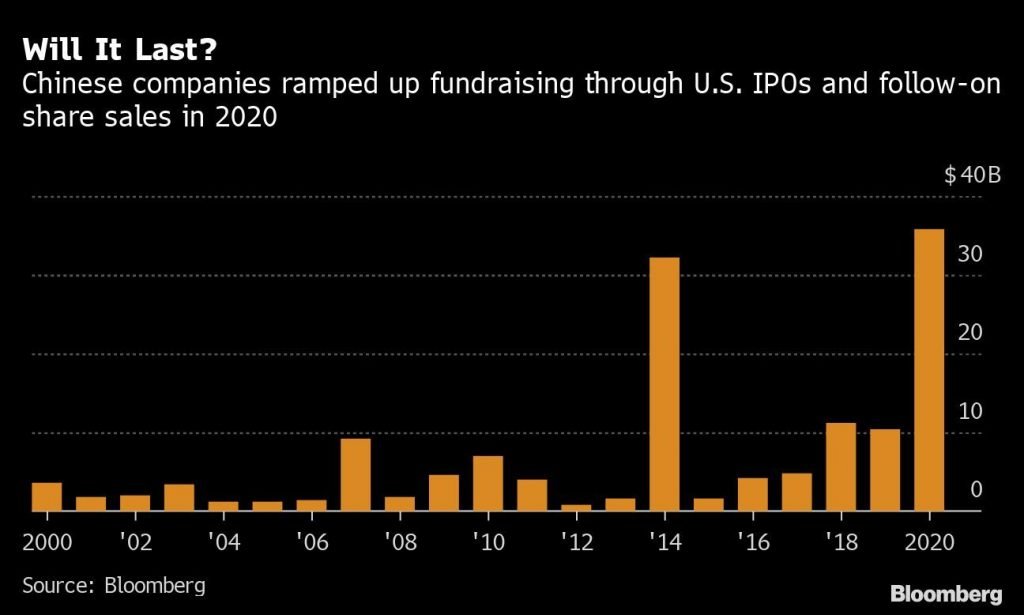

The combined market value of China-domiciled companies with at least a portion of their shares traded in the US is now above $ 1.9 trillion, a list that includes Alibaba Group Holding Ltd to NetEase Inc and JD. com inc. Chinese companies raised a record $ 36 billion from the US