Vehicles registered under the BH system will be levied road tax for two years and thereafter in multiples of two, instead of the owner paying the full amount of road tax for 15 years in advance.

Moving a car or two wheeler to another state can often be a pain. One has to obtain an NOC from the current state and then re-register the vehicle in the next state where the vehicle will be shifted. There is also the matter of paying road tax again to the next state.

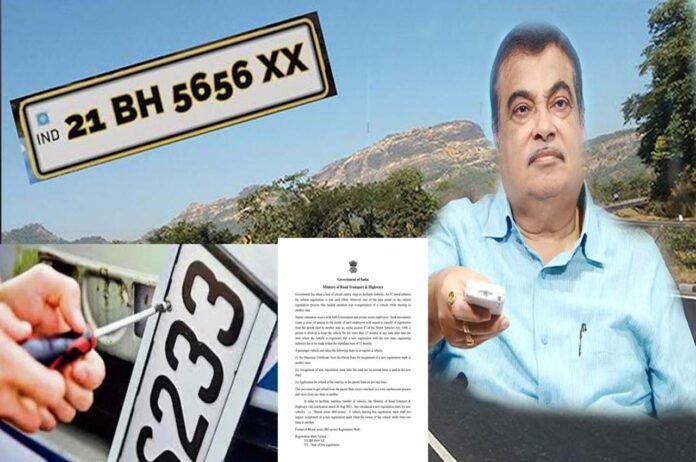

To free the vehicle owners from all this hassle, the Ministry of Road Transport and Highways has notified the registration of “BH” series of Bharat series which people can opt for.

People who are in transferable jobs, such as defence, railways, other government employees or even private sector employees whose companies are present in multiple states, often face this lengthy paperwork and process regarding their vehicles. Does matter. With the implementation of this new system, this problem will go away.

Currently, when a person shifts to another state and wants to take his vehicle with him, he has to first obtain a no-objection certificate from the state where the vehicle is currently registered. The government calls this the “original” condition of the vehicle. NOC of origin state is required for assignment of new registration in another state.

And fresh registration is necessary because under section 47 of the Motor Vehicles Act, 1988, a vehicle can remain in another state with the same registration for 12 months, during which it has to be re-registered in the new state. It also applies for refund of road tax on proportionate basis in the state of origin.

This is because when someone buys and registers a new private vehicle, the state government, or the state of origin, charges road tax for the entire registered life of the vehicle, which is 15 years.

When the same vehicle is shifted to another state, let’s say, after five years, the originating state has to refund the remaining 10 years of road tax that it has already received. In the new state, the vehicle owner pays the calculable road tax for the remaining period of the vehicle’s life, such as 10 years.

The government has finally realized that this provision of getting refund from the originating state is a very cumbersome process and varies from state to state. One has to wander his way through the bureaucratic maze of regional transport offices and face many obstacles.

The government-state and the center-so far no such arrangement has come in which the rest of the road tax should be transferred from one state to another.

The new system of allotting BH Series registration to vehicles will be completely online without the vehicle owner having to trace the complicated red tape.

The government has amended Rule 47 of the Central Motor Vehicles Rules, 1989 to make it mandatory that vehicles bearing the BH registration mark will not need to be re-registered in the new state after being shifted.This will come into effect from September 15 this year.

Any person who is a Government/PSU employee, State or Central, is eligible. In the private sector, an employee of a company having offices in at least four states/UTs is eligible to obtain a BH number on a voluntary basis. He/she has to apply by filling Form 60 and submit valid employment ID/ proof online. The state officials will verify the proof and then provide the BH registration. The registration number will be generated randomly by the computer.

Vehicles registered under the BH system will be levied road tax for two years and thereafter in multiples of two, instead of the owner paying the full amount of road tax for 15 years in advance. This frees the owner from seeking refund before or after the transfer as the tax has not been pre-paid. After the completion of the fourteenth year, motor vehicle tax will be levied annually which will be half of the amount charged earlier for that vehicle.

The government has defined that for a BH registration vehicle, the road tax will be charged at 8 per cent if the cost of the vehicle is below Rs 10 lakh. It is 10 per cent for those costing between Rs 10-20 lakh. And for vehicles costing more than Rs 20 lakh, the tax is 12 per cent. The Ministry of Road Transport and Highways received several suggestions as well as carried out deliberation with states before coming up with this notification. Diesel vehicles will be charged 2 per cent extra Electric vehicles shall be charged 2 per cent less tax. The road tax charged varies from state to state, but this is largely the range anyway.

BH number may look like “21 BH XXXX AA”. In this the first two digits is the year of the first registration, BH is the code for the series, the four numbers (XXXX) are randomly generated, followed by two letters of the English alphabet.