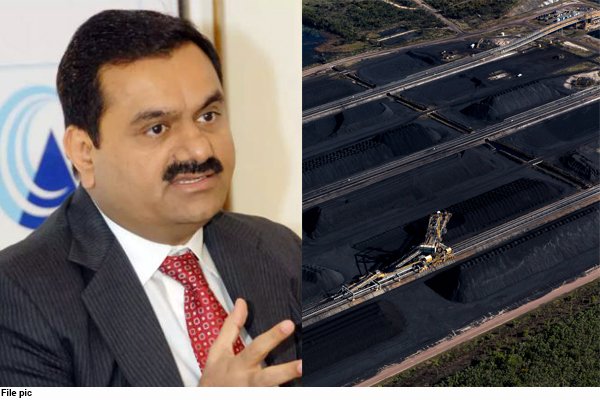

A day after the Adani group decided to call off the Rs 20,000-crore follow-on public offer (FPO) and return money to investors, chairman Gautam Adani explained the move saying “the interest of his investors was paramount”. And everything else is secondary”.

In a video message on Thursday morning, he said the group will review its capital raising plan once the market stabilises. “In my humble journey of over 4 decades as an entrepreneur, I have been fortunate to receive overwhelming support from all stakeholders especially the investor community.

It is important for me to acknowledge that whatever little bit I have achieved in life is because of their faith and trust. I give the credit of all my success to him. For me the interest of my investors is paramount and everything else is secondary. Therefore, to protect investors from possible losses, we have called off the FPO.

This came after its FPO floated with non-institutional investors including HNIs and family offices of industrialists. as collateral for margin loans to its private banking customers.

At the end of the day, Adani Group Chairman Gautam Adani’s personal net worth fell by $14 billion to $74.7 billion, catapulting him to No. 15 on Forbes’ billionaires list – down from No. 3 barely a few days ago. All Adani Group stocks were down, with Adani Ports falling 19.7%.

Adani group companies have lost market capitalization of over Rs 7 lakh crore after US-based Hindenburg Research report accused the group of “brazen stock manipulation and accounting fraud”. Bank stocks also took a beating following the fall in Adani’s shares. A market source said markets were worried about further fall in Adani shares and there was pressure from investors who had put money in the FPO to withdraw the issue.