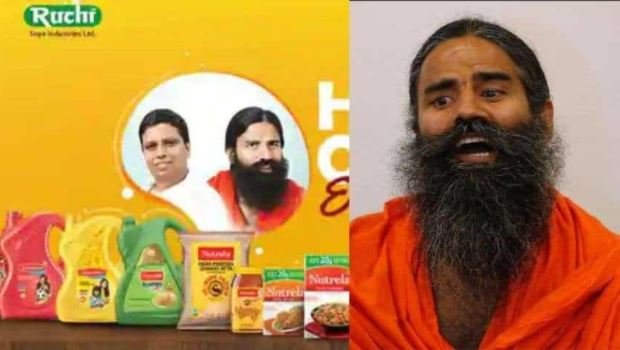

New Delhi: Edible oil firm Ruchi Soya, which is owned by Baba Ramdev-led Patanjali Ayurved, is likely to enter the capital markets with its follow-on public offering (FPO) in the last week of this month. The public issue is expected to raise Rs 4,300 crore.

In August last year, the company had received capital markets regulator SEBI’s nod to launch an FPO. It had filed a draft red herring prospectus (DRHP) in June 2021.

The Company is initiating a public issue to meet SEBI’s norm of minimum 25 per cent public shareholding in a listed entity.

According to market sources, the company is in the final stages of launching its FPO in the last week of February 2022 to increase the company’s public inflows.

According to DRHP, Ruchi Soya will utilize the proceeds of the entire issue for furtherance of the company’s business by repayment of certain outstanding loans, its increasing working capital requirements and meeting other general corporate objectives.

In 2019, Patanjali acquired Ruchi Soya, which is listed on stock exchanges, through an insolvency process for Rs 4,350 crore.

Promoters currently hold around 99 per cent stake. The company needs to sell at least 9 per cent stake in this round of FPO.

As per SEBI norms, the promoters’ stake needs to be reduced to achieve a minimum public stake of 25 per cent in the company. It has about three years to bring down the promoters’ stake to 75 per cent.

Ruchi Soya primarily deals in the business of processing oilseeds, using crude edible oil as cooking oil, manufacturing of soya products and value added products.

The company has an integrated value chain in the Palm and Soya segment with a farm to fork business model. It has brands like Mahakosh, Sunrich, Ruchi Gold and Nutrela.

(with agency input)